8 tips for buying a used car from a dealership

My husband’s car died a few weeks ago. Kaput. Engine blown. No redemption.

So, we found ourselves in the position of needing to purchase a car relatively immediately. Living in a city and parking on the street, we decided “new” was not in our best interest.

Since used cars are not my forte, I reached out to the “Autorati” – my automotive colleagues on Facebook. After checking out some articles in The Chicago Tribuneand on She Buys Cars, we locked in on a car new to us – and learned a lot in the process.

Tip 1: Set a budget

This is a tough one because the vehicle price and what you pay will not be the same.

If you have $20K to spend on a vehicle, you’re probably looking at a sticker price around $15K. There are a lot of taxes and fees that come with buying a car – and they’re expensive.

For example, car sales tax in the city of Chicago is 8.75 percent, registration will cost $101 and the title fee is $95. So, if you look at a car that’s $15K, the minimum you’ll pay walking out the door will be $16,509.

So, start by getting a handle on what you can afford to pay on a monthly basis. Then go to a car calculator that looks at your monthly payment first. We like the Affordability Calculator on Edmunds.com.

Add into the calculator your target monthly payment, loan term and market finance rate (use 5 percent” regardless of what it prepopulates), what your down payment will be, etc. Then hit calculate, and it will give you a range of sticker price you can afford.

Pro tip: When you are looking at finance options, whoever is giving you the loan should show you what your payments will look like with different down payments and loan terms. We recommend that you get nothing more than a 36- or 48-month loan for a used car.

Tip 2: Do your research

In addition to knowing what you can afford, visit the True Car app or website to get a sense of which cars are available near you in your price range. You can simply look at cars in your price range or drill down into specifics of make and model.

Once you get a list of cars, TrueCar rates the price and will tell you if it’s listed below market value and by how much. If you drill down to a specific car, it’ll even show you a bell curve of the estimated average price of a similar vehicle.

For due diligence, you’ll also want to visit the Kelley Blue Book app or website, which will let you spec out a car and get an idea of what a dealer likely purchased the vehicle for (the “Trade In” tab). And if you click on “Sell to a Private Party,” you’ll be in the ballpark of what you should offer the dealer for the vehicle.

Pro tip: Print out your research – especially if you are targeting just one or two cars. This shows the dealer you’ve done your homework on this vehicle specifically, and it keeps you from fumbling with your phone to find the right thing on the app.

Tip 3: Check the VIN

Most dealerships these days will provide you with a Carfax Report that will give you a good idea of the vehicle’s service history. It will show if the vehicle has had any recalls, damage, accidents or airbag deployments.

If you want this information in hand before you go to the dealer, there are various for-fee services that will do this online. KBB uses AutoCheck, which charges $24.99 for a single report or $49.99 for up to 25 reports in 21 days.

Pro tip: Be wary of anything that shows a gap in service. One vehicle we looked at had two owners, with the first owner putting on 5K miles and meticulously servicing it. The second owner had the car for 1 year, put 20K miles on it and never serviced it. That was a red flag to us that made us walk away – even though this was a lower mileage vehicle.

Tip 4: Do an extended test drive

A 10-minute loop is not enough for you to say: Let’s buy this car immediately! I don’t know about you, but for me, buying a car is not an impulse purchase.

Ask the dealer for a 24-hour test drive. As long as you have good automotive insurance, this should not be a problem. If it is, see tip 8.

During your extended test drive, open it up on the highway, drive the way you would without a car salesman hanging on to the grab handle in the jump seat. Put your golf clubs in the trunk. Figure out where you purse or briefcase will go. Strap your kids or wife or parents in the back seat. Park it in your garage.

Basically, drop it into the middle of your life and see how it fits.

Oh, and if you have anyone else who will possibly be a driver of this vehicle, they also must get behind the wheel.

Pro tip: Run some errands in the car with passengers. You know your golf clubs will fit, but how about those groceries? What about that big box you need to pick up from the post office? If you have booster seats or car seats, you definitely want to check the ease of installation – and how easy it is to get kids in and out of those positions. Plus, someone sitting in the back seat or passenger seat will likely see something you don’t because you’re focused on driving.

Tip 5: Have an independent mechanic take a look

This is a must. The dealer will tell you their mechanics did a 100-point, 200-point, whatever-point inspection, but you don’t know what they were looking at or for. More importantly, they don’t work for you. They work for the dealer who is trying to sell you something.

If you have a regular mechanic, you’ll want to alert him to the fact that you’re looking at used cars before you go shopping and ask him if he’s willing to check out a vehicle you may buy. If you don’t have a regular mechanic, find one.

You should not buy a car without independent verification that everything is OK.

Before going to your mechanic, get a copy of what the dealer says they have repaired or replaced on the vehicle since it came into their car. You can give that to the mechanic to verify as well.

Pro tip: You can take care of this during your extended test drive. While you have your mechanic’s ear, it might also be a good idea to ask what it would cost for common repairs, so you have an idea of what to budget just in case.

Tip 6: Don’t sign until you’ve negotiated everything

Think of everything you want, and make sure that you’ve talked it out with the car salesman before you start on the paperwork. Once you are sequestered with the finance department, it’s a lot harder to ask for anything extra unless you are willing to walk away from the deal completely.

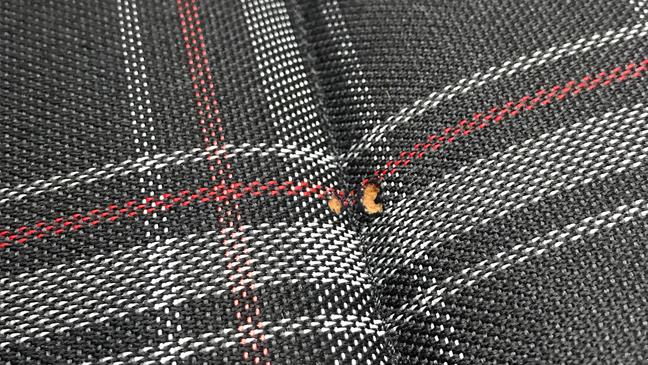

The car only has one set of keys? Negotiate down the cost of what it will be to get an extra set. The rear seat has a tear in the cloth, get it in writing that the dealer will fix it after the purchase is complete.

The extended test period is a good time to make this list – not while you’re sitting a desk with a car salesman staring at you.

Keep in mind that the key word is negotiate. You want to feel like you got a good deal, but the dealer needs to make money, too.

Pro tip: You probably aren’t going to get everything that you want. But if you can get most of what you want, and you’re happy with the car and the purchase price: Consider it a win and call it a day.

Tip 7: Get the extended warranty

When you are buying a used car, you are – for better or worse – buying someone else’s habits and problems. Regardless of what the dealer says (This was owned by a grandma, who only drove to and from church on Sundays ), you have no idea who was driving this car or how well (or poorly!) they drove it.

At the very least, get the basic warranty that will last for the life of your loan. This will cover everything except consumables, such as brake pads, tires, transmission, etc.

Pro tip: If you are borrowing money to buy a used car, it’s a good idea to get “Gap Coverage” for the life of your loan. In the event of a crash or catastrophic natural disaster, this will cover the balance of your loan after whatever check the insurance company gives you when totaling out your car. You can either get this at the time that you purchase the vehicle or from your auto insurance provider.

Tip 8: Be prepared to walk away

Buying a car is one of those stressors that ranks up there with losing a job and a death in the family. It’s not a fun process. So, before you go into it, you need to know your limits and be willing to walk away.

Seriously.

If you don’t get what you want or you’ll over extend yourself on payments to get that feature you don’t really need but the dealer insists you have, walk away.

Pro tip: If you’re one of those people who doesn’t like confrontation but you need to find a way to walk away, tell the dealer you have a doctor’s appointment or physical therapy appointment or dentist appointment or something! You can circle back with them after the “appointment” via phone, which will make it easier for you to say, “No, thank you.”

Lessons learned

Did my husband and I do all this perfectly? No. We did not. We were under a deadline and needed to move quickly. Plus, my husband is stubborn (love you, honey), and he had his mind set on one vehicle. Period. Which kind of limits your ability to negotiate.

But we did all the important stuff right – including the extended test drive and a visit to an independent mechanic.

If you do nothing else when buying a used car, do those two things. If a dealer balks at either of them, we go back to Tip 8 and walk away. Why? This tells us the dealer may have something to hide and leaves us with a bad feeling.

After a 48-hour crash course in research and used-car test drives, my husband and I now own a new-to-us car, and we are both happy with the car and the price we paid for it.